What is AI trading?

AI trading refers to the application of algorithms and techniques from the area of artificial intelligence to facilitate trading activities in financial markets. Algorithms utilized are mainly from machine learning (ML) and deep learning.

A component that is paramount to AI trading systems is learning from historical data. By ingesting vast amounts of historical market data, these algorithms endeavor to discern patterns, trends, and anomalies that might not be evident to human traders. Through the power of machine learning, AI trading systems aim to adapt and evolve their strategies based on these learned insights.

These systems are designed to process not only numerical data like price movements and trading volumes but also textual data such as news articles, earnings reports, and social media sentiments. By integrating this diverse range of information, AI trading models attempt to gain a more comprehensive understanding of market dynamics and potentially make more informed trading decisions.

AI Trading vs Traditional Algorithmic Trading

As an up-and-coming approach to automated trading, AI trading has its distinct advantages and disadvantages to traditional algorithmic trading. Although one could argue AI trading is a subcategory of algorithmic trading, this new approach has its core differences.

Traditional algorithmic trading involves the use of hardcoded rules and strategies to automate trading decisions. These algorithms are typically designed by human traders and are based on technical indicators, statistical patterns, and mathematical models. While they can execute trades with speed and precision, traditional algorithmic trading systems often rely on static rules that may struggle to adapt to rapidly changing market conditions or unforeseen events.

Then come AI trading systems, which could utilize the aforementioned indicators and patterns as input data, but also other data such as news article sentiment, numbers from reports and whatever the algorithm designer would like to utilize. In a sense, these systems widen the field of possible inputs to the algorithms. However, a key difference with the prior is that most often AI algorithms are “black boxes” with low explainability. That means after the process of training or learning from data, an engineer could hardly explain why the algorithm has taken some decision.

Apart from that, AI trading bots have the ability to find complex patterns and causalities between inputs and outputs, which human-built traditional systems are not able to envisage.

Moreover, the former can evolve and adapt to structural changes in the data and its patterns. That is because one can create a re-training procedure, which teaches these systems to the latest knowledge. This is a key advantage of AI trading systems.

In terms of complexity, AI models are generally more complex than traditional systems. They also require more computational resources, because knowledge is usually stored in the parameters of models, which are just floating point numbers. To store and learn this knowledge by itself, instead of having it hard-coded, ML models need more storage and compute.

To conclude, here is a summary of the highlighted points:

| Aspect | AI Trading Systems | Traditional Trading Systems |

| Input Data | Utilizes a wide range of inputs, including indicators, patterns, news sentiment, etc. | Primarily relies on technical indicators and patterns. |

| Explainability | “black boxes” with low explainability. | Rule-based logic allows for better explainability. |

| Pattern Discovery | Can identify complex patterns and causalities in data. | Limited in its ability to foresee intricate patterns. |

| Adaptability | Can evolve and adapt to structural changes in data. | Struggles to adapt to rapidly changing market conditions. |

| Evolution through Re-training | Can undergo re-training procedures to incorporate new knowledge. | Lacks the capacity for dynamic re-training. |

| Computational Complexity | Typically more complex and resource-intensive. | Generally simpler in terms of complexity and resources. |

| Utilization of Computational Resources | Requires more computational resources due to complex models. | Requires fewer computational resources. |

AI Trading Methods

Here we will explore some of the most prominent methods for AI trading. What big corporations such as JP Morgan use is strictly proprietary, however, it is very likely that they use some of these core classes of algorithms.

Reinforcement Learning Based Methods

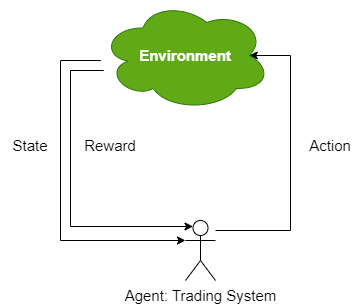

Reinforcement learning, particularly deep reinforcement learning (DRL), are amongst the most common approaches when using AI in trading systems. In trading, the agent – the ML trading bot – learns to make decisions by interacting with the market over time. It infers the state of the environment, which in the case of trading is the stock market, and takes actions depending on that state. By selecting actions such as buy, sell, or hold, the RL-driven agent seeks to maximize a predefined objective, such as profit or risk-adjusted return. This objective is called reward function.

DRL builds on traditional reinforcement learning by employing deep neural networks to approximate the optimal trading strategy. This allows for much more complex patterns based on state and actions to be learned. Moreover, it allows for continuous state spaces and even sometimes continuous action spaces.

Evolutionary Methods

Imitating the survival-of-the-fittest principle, evolutionary methods employ genetic algorithms to simulate the process of natural selection. Strategies that prove less effective are cast aside, while those displaying potential get selected for future generations. The selected ones get randomly combined through crossover and randomly mutated, just like in natural evolution.

That way, with generations and generations of strategies being evolved, very well performing ones emerge.

Now, you might wonder how are these strategies represented in order to be evolved and combined. Well, they could be represented as neural networks even, stored as sets of weights. This is what the prominent NEAT (Neuroevolution of Augmented Topoliogies) algorithm does.

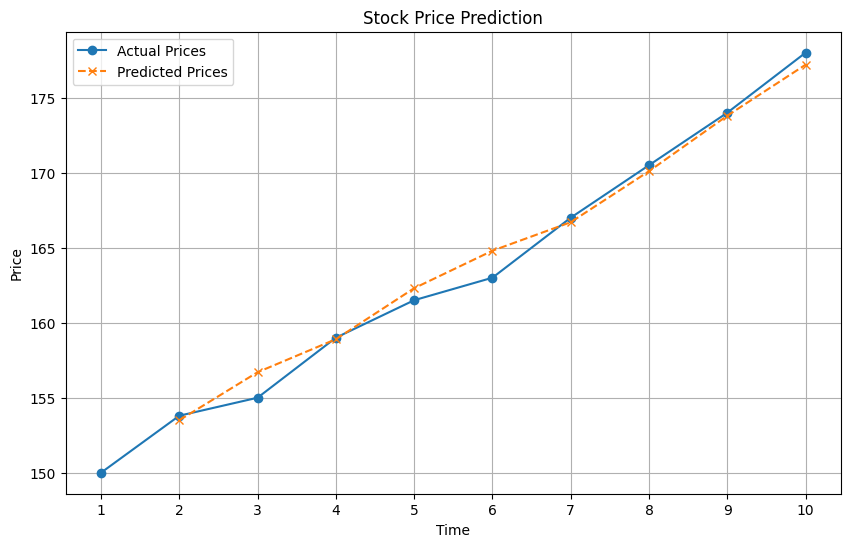

Stock Price Prediction Models

The stock price prediction models are generally simpler ML and deep learning models that are fed different data points, such as price, indicators, news and events, etc. The output is either a continuous value – the stock price or a categorical variable – return ranges for a given feature time period.

For example, there might be 4 output categories: less than -5%, -5% to 0%, 0% to 5% and more than 5% returns for the next day let’s say. So, the model would predict one of the 4 categories as most likely.

In this approach the models commonly used are simple dense neural networks, LSTM networks and even Convolutional Neural Networks.

With this said about price prediction models, practice has shown that they are subpar to reinforcement learning methods, because they directly optimize for the actions that yield the highest reward.

Corporations against Amateur Individuals

If one wants to build profitable trading AI systems, they have to take into account that trading is a zero-sum game. Wherever someone wins $100 in the markets, someone else loses $100. That means that an individual amateur AI trader has to compete against the biggest investment banks and hedge funds.

This is bad news for individuals because large corporations like JP Morgan and renowned hedge funds like Jim Simons’ Renaissance Technologies possess a significant edge them when it comes to building AI trading bots. One of the primary reasons is their substantial financial resources. These institutions have the financial capacity to invest heavily in research and development, recruit top-tier AI talent, and deploy cutting-edge technology infrastructure. And even more importantly, they are able to access vast and high-quality datasets, historical market information, and alternative data sources, granting a comprehensive view of market trends and patterns that individual traders do not have a chance to acquire.

So, if you are looking to get into AI trading, you should be aware of all the risks and the fierce competition. Nevertheless, theoretically if you find a small niche where you can get a small edge over other market participants, you should be able to run a successful AI trading system.

Conclusion

AI trading is the deployment of artificial intelligence algorithms that learn from data in the domain of trading, be it stock trading, FX trading or crypto trading. In many cases they are better than hard-coded trading systems, hence the wide adoption by ‘smart money’. This endeavor is potentially so lucrative that even individual traders are trying to deploy their own systems. However, the industry is extremely competitive, so one should be aware of the risks when getting into AI trading.

In my opinion, automated trading systems are here to stay as human practitioners (traders) simply cannot analyze complex causality patterns and execute trades as fast as computers can. The revolutionary drift of automated trading can be seen on the trading floors of the NYSE and others. With the rampant adoption of AI trading systems, we are likely to see a new revolution on Wall Street.

Stay tuned for more tech and AI insights! Stay updated with the latest developments by subscribing to Rate of Tech today.

Related articles:

How AI Sees Me?

Stunning Billie Eilish AI Art

Leave a Reply